To use the PSBank Mobile Check Deposit service, you must have a total Deposit Relationship Balance of PhP50,000.00 (combined Month-to-Date Average Daily Balance (ADB) for the relevant month, or Outstanding Balances of Savings Account, Checking Account, Time Deposit, and Prepaid Account).

US Dollar-denominated accounts are included with a fixed foreign exchange conversion rate of PhP50: USD 1

UITF and Loan Accounts are not included.

ELIGIBLE CHECKS

- Drawn on PSBank or other local banks;

- Payable in Philippine currency only;

- Dated not more than 6 months or 179 days prior to the date of deposit;

- Payable to the customer that owns the account where the check is being deposited to. Checks that are payable to “joint and” accounts are not acceptable;

- Completely filled out, signed, with “For Electronic Endorsement to PSBank Only” written at the back of the check, endorsed or presented in accordance with the pertinent laws on negotiable instruments;

- Checks shall not have any alterations or technical defects;

- The entire amount indicated in the check must be deposited to the client’s current/savings account; partial negotiation shall not be allowed under this service;

- Must not have been previously endorsed/negotiated/presented, either manually or electronically. Checks previously deposited through PSBank Mobile Banking which were returned may be directly deposited to any PSBank branch, if for re-deposit or second presentment.

- Checks are acceptable under the terms of PSBank Account and not prohibited by PSBank under the current rules relating to the service.

ELIGIBLE TARGET ACCOUNTS

Active Current or Savings Accounts

Note: Time Deposits, Prepaid Accounts, Accounts tagged as Cash-Basis-Only (CBO), UITF, Loan Accounts, and accounts with other restrictions (dormant, closed, etc.) are not eligible as target accounts.

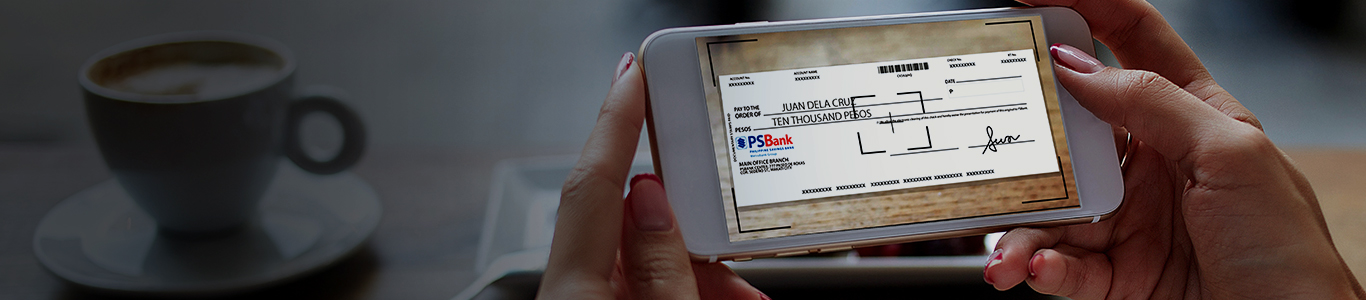

HOW TO USE THE MOBILE CHECK DEPOSIT FACILITY

- Log in to the PSBank Mobile App

- Select “Deposit Check” (Note: you may also go to the “Create a Transaction” module in the Mobile App to make a deposit)

For first-time users, read the Terms and Conditions, tick “I Agree” and click “Proceed.”

- Choose the target account where the check will be deposited to.

- Encode the amount of the check.

- Sign at the back of the check and indicate “For Electronic Endorsement to PSBank Only”, DATE OF DEPOSIT, and the account number where the check will be deposited to.

- Take a photo of the front and back of your endorsed check with your mobile device.

Please follow these guidelines:

TAKE FRONT PHOTO OF THE CHECK

- Ensure that the check is completely filled-out and has no marks, erasures, or alterations

- Ensure photo is not blurred, and all text are clear and readable. We strongly recommend taking the photo in a well-lit room. Avoid having any reflection or shadow in the shot.

- When cropping the check image, adjust the cropping tool to match the check’s edges. Avoid blank spaces.

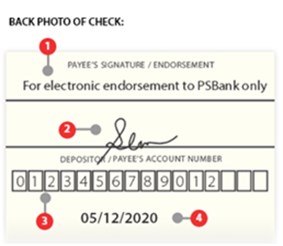

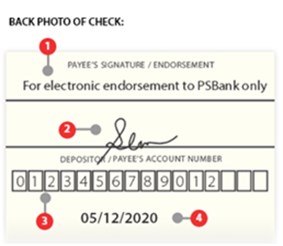

TAKE BACK PHOTO OF THE CHECK

- Make sure to legibly write the following information at the back of the check before you take a photo:

- “For electronic endorsement to PSBank only”

- PSBank Account Number where the check will be deposited to

- Your endorsement or signature

- Date of deposit

- When cropping the check image, adjust the cropping tool to match the check’s edges. Avoid blank spaces.

REMINDERS:

- Provide the required information at the back of the check (see illustration below for your reference):

- Indicate “For electronic endorsement to PSBank only”

- Your signature

- PSBank account number where the check will be deposited

- Date of deposit

- Checks with any erasures, alterations or with multiple account numbers written at the back side of the check shall not be accepted for deposit.

- Submit check images for processing

Note: Checks will be subject to image quality checking to ensure compliance with PSBank and PCHC standards. Checks shall likewise be reviewed by PSBank for its technicalities and compliance with the bank’s guidelines. Only acceptable checks shall be submitted for clearing / processing.

AVAILABILITY OF FUNDS

Checks received within the set clearing cut-off (3:00pm) shall be processed within the day. Checks received after the clearing cut-off shall be processed on the next banking day.

Limits

| Transaction Amount Limit per check |

PhP100,000.00 |

| Customer Limit per Month |

PhP200,000.00 |

| Velocity Limit per customer, per day |

50 checks |

Velocity Limit per customer, per month

|

100 checks |

Fees

None