PSBank Posts PhP 2.85 Billion Income for the First 9 Months of 2025

Philippine Savings Bank (PSBank), the thrift banking arm of the Metrobank Group, reported a net income of PhP 2.85 billion as of end-September 2025. Net interest income rose by 8% year-on-year to PhP 9.85 billion, fueled by sustained loan demand across consumer and SME segments. Total loan portfolio continued to register double digit expansion, increasing by 12% to PhP 155 billion as of the third quarter of 2025. Gross non-performing loan (NPL) ratio remained in check at 3.5%.

The Bank's productivity initiatives limited the increase in operating expenses at 2% year-on-year, contributing to a 3% pre-provision operating profit growth. Compared to 2024, credit provisions were higher due to last year’s one-off updates in its expected credit loss model.

Total resources stood at PhP 222 billion while deposits ended at PhP 164 billion as of September 30, 2025. Total capital reached PhP 46 billion, with a capital adequacy ratio of 24.6% and a Common Equity Tier 1 ratio of 23.6%—both are well above the regulatory minimum set by the Bangko Sentral ng Pilipinas and are among the highest in the industry.

“The steady growth in our lending business reflects the trust and confidence of our customers in our commitment to offer simple, reliable, and accessible products and services. As we approach the homestretch of 2025, we will continue to rely on our core business strength and operational efficiencies to provide us a platform for sustainable growth in the coming years. said PSBank President Jose Vicente Alde.

The Bank successfully listed its Php 5 billion fixed-rate bonds on the Philippine Dealing & Exchange Corp. (PDEx) last August 2025. Originally scheduled to run from August 4 to 8, 2025, the public offer period was cut short to one day due to strong investor demand, with orders reaching more than six times the base offer size.

PSBank recently brought home multiple honors — the Bank was awarded Best Disbursement Partner for the Thrift Bank Category in SSS Balikat ng Bayan awards. PSBank also won the Bronze Award for Excellence in Mobile Marketing for PSBank Mobile at the 5th Marketing Excellence Awards, the Bronze Award for Excellence in Employee Volunteerism at the 4th HR Excellence Awards Philippines, and two Merit Awards at the 21st Philippine Quill Awards for the PSBank 2023 Annual Report (Publications category) and Sana Lahat Simple Campaign (Social Media category). PSBank was among the recipients of the 2025 Golden Arrow Award from the Institute of Corporate Directors, recognizing its strong corporate governance practices.

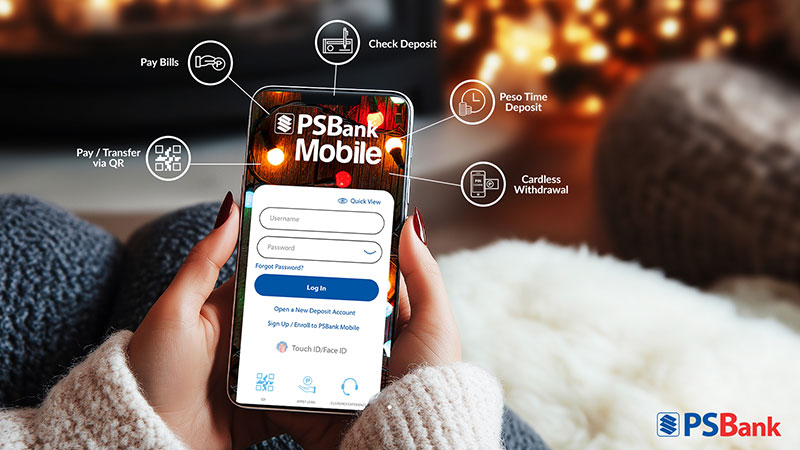

Bank on Safety: How PSBank Mobile Puts Security in Your Hands

See how PSBank Mobile makes secure banking simple and convenient

You’re enjoying your day when a text from “your bank” warns your account will be locked unless you click a link. It looks real — but it’s a phishing scam designed to steal your information.

Banking today is easier than ever. With just your smartphone, you can transfer funds, pay your bills, send money to friends and loved ones, or even apply for a loan wherever you are. What used to take hours to do can now be done in minutes, right at your fingertips.

While this digital shift puts more control in Filipinos’ hands, it also creates new opportunities for scammers — from fake websites, fraudulent calls, and social media phishing.

That’s why cybersecurity is no longer something just for businesses or tech experts. It’s an everyday necessity for anyone who uses a banking app or card. Being vigilant matters, but equally important is having the right tools to keep yourself protected.

“Digital banking has brought our customers unmatched convenience, but it has also made fraudsters more creative. At PSBank, our approach is simple: empower our customers with tools that let them respond quickly and confidently the moment something suspicious happens,” said Dan Duplito, PSBank Chief Information Security Officer.

Safe Banking at Your Fingertips

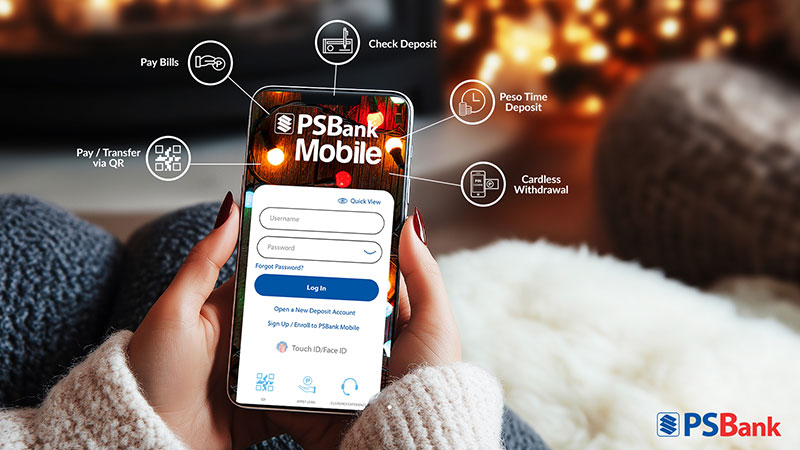

PSBank Mobile is designed with built-in safety features that put you in control the moment something feels off.

If you misplace your ATM card or suspect unauthorized use, you can instantly block all transactions with just a few taps—and unlock it just as easily once it’s safe again. For added protection, especially if you prefer using the mobile app over a browser, you can disable online access directly from the app to further safeguard your account.

Real-time transaction notifications keep you informed about exactly when and how your account is being used. And if you spot anything suspicious, you can immediately lock your ATM card or disable online access to stop potential fraud in its tracks.

Effortless Banking

Strong security doesn’t mean giving up convenience. With PSBank Mobile, you can manage your finances seamlessly — from paying bills for utilities, credit cards, school fees, insurance, and more, to reloading your AutoSweep or EasyTrip RFID instantly, with the option to save your details for faster top-ups.

You can send money via InstaPay or PESONet, make cardless withdrawals at any PSBank or Metrobank ATM, and even deposit checks by simply taking a photo. Plus, you have the flexibility to view all your accounts in one screen or check them individually, giving you full control anytime, anywhere.

Your Money, Your Control

Protecting your money isn’t just about strong passwords — it’s about having constant visibility and the power to act the moment something’s wrong. With PSBank Mobile, security isn’t an add-on. It’s built into the way you bank, every day.

Download the PSBank Mobile App today via the Apple App Store, Google Play Store, or Huawei AppGallery. For more information on PSBank's products and services, visit www.psbank.com.ph or follow PSBank on Facebook.

First-Time Driver? Here’s What You Need to Know

Take the wheel with confidence – start your car ownership journey the simple way with PSBank

Ready to leave the passenger seat and take the wheel?

Maybe you’ve been dreaming of a car to make the daily commute easier, enjoy solo drives and weekend getaways, or simply skip the hassle of waiting for a ride. Whatever the reason, becoming a first-time driver isn’t just a rite of passage—it’s the beginning of a new chapter filled with freedom, responsibility, and endless adventures.

From getting your first car to managing the responsibilities of ownership, PSBank is here to make every step simple and worry-free.

Taking Your First Steps

Your journey begins with the LTO Theoretical Driving Course—a 15-hour seminar on driving basics and road safety offered by accredited schools, either online or in a classroom. After passing the exam, you can apply for a student permit.

Next, prepare for the written and practical tests to secure your driver’s license. Online reviewers and practice exams can help sharpen your knowledge and confidence. Be sure to schedule your medical exam and license application before your permit expires to avoid delays. For the complete process and official requirements, visit the LTO website. Follow these steps, and you’ll be on your way from learner to licensed driver in no time.

Choosing Your First Car

Picking your first car is exciting, but beyond looks and power, it’s about finding what truly fits your lifestyle. If you’ll be driving through city streets every day, a hatchback or sedan offers comfort, efficiency, and easy maneuverability. For those often traveling with family or bringing along more essentials, an MPV or crossover provides the space and flexibility you need. And if your routes include rough or unpaved roads, an SUV with higher ground clearance is the perfect match, giving you both capability and room to move.

Still deciding? PSBank’s Loan Calculator makes it easy to check how much you’ll need for the downpayment and monthly amortization, so you can compare and choose what works best for you.

Once you’ve found the right car, applying for a PSBank Auto Loan Online is quick and easy. You can apply online and get a loan decision in as fast as 24 hours.

Meanwhile, if you’re looking for budget friendly options, you can browse PSBank’s list of Pre-owned Cars for Sale online, or visit the PSBank Pre-Owned Auto Mart at 8003 Lands R Us Realty Compound, Manalac Ave., Bagong Tanyag, East Service Road, Taguig City. Units are available for viewing from Monday to Saturday, 8:00 a.m. to 4:30 p.m.

Mastering Your Car’s Care

Owning a car means more than just driving—it comes with responsibilities that keep you safe and confident on the road. Start by understanding your car: know what the dashboard lights mean and how to use features like hazard signals and defoggers.

It’s also important to make sure your car is properly insured to protect you financially in case of accidents. Once on the road, drive smart—stay alert, follow traffic rules, and maintain a safe distance from other vehicles. Don’t overlook the basics either: check your tire pressure regularly, know how to jump-start your battery, and keep up with routine maintenance. These simple habits not only keep you safe but also extend the life of your car.

Just as important as taking care of your car is staying on top of your monthly payments. With PSBank, managing them is simple—you can pay through PSBank Mobile, PSBank Online, over the counter at any PSBank branch, or even at select partner outlets like 7-Eleven.

For extra convenience, you can also set up an Automatic Debit Arrangement (ADA) from your PSBank savings account. Don’t have one yet? Opening a PSBank savings account is quick and easy—just download the app, present one valid ID, take a selfie, and you’re good to go.

Here’s a bonus: when you make either or both advance or excess payments, you automatically earn rebates through the Prime Rebate feature. That means you can cut down your total loan amount, shorten your loan term—or enjoy both.

Facing The Road Ahead

Getting behind the wheel for the first time comes with big responsibility. Always buckle up, keep your eyes on the road, and avoid distractions like using your phone while driving. Know your traffic signs and follow speed limits—they’re there to keep everyone safe.

If you’re heading somewhere unfamiliar, plan your route ahead or use a navigation app so you can focus on driving instead of rushing to figure out directions. Most of all, stay calm and patient—safe driving isn’t just about skill, it’s about being alert and considerate on the road.

Keeping your car in top shape is just as important as driving it safely. Always follow your manufacturer’s recommended Periodic Maintenance Schedule and have your vehicle serviced only at authorized franchise dealers to keep your warranty intact.

For added safety and to make sure your warranty provisions remain valid, choose only genuine parts and accessories installed by trained mechanics.

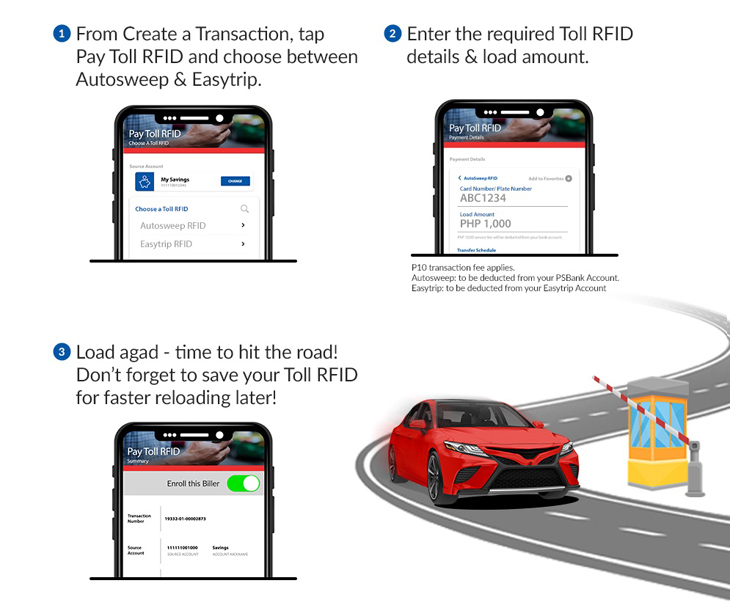

For smoother trips, make sure your vehicle is equipped with RFIDs like AutoSweep and EasyTrip for cashless toll payments. And the best part? You can conveniently reload them anytime through PSBank Mobile.

Your Maaasahan Partner on the Road

Buying your first car is exciting, but figuring out the financing can feel a little overwhelming. PSBank offers Auto Loan options that are simple and flexible, making it easier for first-time buyers to get started. Whether you’re applying for a loan or just need guidance through the process, PSBank aims to make the process smoother so you can focus on enjoying the road ahead.

If you are a first-time driver ready to turn your dreams into reality, PSBank is here to help. Apply for a PSBank Auto Loan through PSBank Online Loan Application or visit your nearest PSBank branch. For more information, visit www.psbank.com.ph or follow PSBank on Facebook.

How to Find Your Dream Home at Every Life Stage

Make the search easy with PSBank Home Loan

Make the search easy with PSBank Home Loan

The dream home you’ve been searching for is closer than you think.

Ready for solo living? Your very own condo—styled to match your aesthetic and paid for with your hard-earned money—could be your next big adulting milestone.

Newlyweds? Imagine turning the page to your brand-new chapter in a home made just for you. Looking to grow your future? A second property could be your smartest investment yet.

And sometimes, a “new home” isn’t new at all—it’s your beloved childhood house, reimagined and refreshed to fit the life you’re building today.

Whatever your reason, owning a home is a milestone—exciting, meaningful, and yes, sometimes overwhelming. Wherever you are in your journey, it always starts with one important question: what feels right for you? Look no further because whatever “home” means for you, PSBank Home Loan with Prime Rebate is here to help make it a reality.

There’s a lot to consider before taking the first step—location, layout, and lifestyle. Maybe you're drawn to the convenience of a condo near the office, or perhaps you prefer the warmth of a quiet subdivision where the kids can play and neighbors feel like family. Sometimes, you don’t need a new address—just a fresh take for the home you already love.

PSBank works closely with trusted developers to streamline the process, so you can get a loan decision in as fast as one day. This lets you choose from a range of thoughtfully built properties and secure financing in one smooth, worry-free experience.

Looking for a more budget-friendly option? PSBank also offers a wide selection of Pre-Owned Homes—practical, move-in-ready choices located in established communities. These homes are ideal for first-time buyers or families looking for greater value.

With loan amounts starting at PhP500,000, plus repayment terms of up to 25 years, you can confidently take the next step to your home. With PSBank’s Prime Rebate feature, you automatically earn interest rebates when you make advance or excess payments so you can pay off your loan faster and save more in the long run.

Make Your Dream a Reality

Whatever your version of “dream home” looks like, PSBank Home Loan with Prime Rebate can help you bring it to life. More than just a loan, it’s a partnership that lets you spend less time on paperwork and more time on what truly matters: creating a space you can call your own.

With easy application requirements, quick approvals, flexible terms, and savings through Prime Rebate, building the right home is now within reach. For more information on PSBank's products and services, click here or follow PSBank on Facebook.

6 Things You Can Do with PSBank Mobile—Right from Your Own Space

Rain or shine, stay on top of your finances with PSBank Mobile

What’s been keeping you indoors lately?

These days, staying in isn’t just about the rain—it’s about slowing down and making space for comfort. When the skies are gray and traffic is heavy, it’s tempting to put off tasks like paying bills or doing your bank errands. Because honestly, who wouldn’t rather stay cozy under a blanket, catch up on the latest movie or series on your favorite streaming platform, or enjoy a quiet afternoon nap?

That’s where little conveniences make a big difference. You can manage your finances right from your phone without having to leave your home. Whether you’re paying bills, sending money, or managing your account, here are five ways PSBank Mobile helps you stay on top of things—rain or shine.

1. Pay Bills Without the Hassle

No long lines. No switching between apps. With PSBank Mobile, you can pay your bills right from your phone – from utilities, credit cards, loans, real estate, and even school fees. To make things even easier, you can set up scheduled payments so you never miss a due date again.

2. Reload Toll RFID in real time!

Running low on toll credits? Skip the hassle of lining up or scrambling for reload options. With PSBank Mobile, you can easily top up your Autosweep and Easytrip RFID accounts—credited instantly so you're always ready for the road. You can even save your RFID details for faster reloading next time, perfect for smooth, worry-free drives ahead.

3. Send Money Instantly

Need to send money? There’s no need to step out or race against over-the-counter cutoffs. With PSBank Mobile, you can transfer funds anytime using InstaPay or PESONet, or simply scan a QR code for quick, secure transactions. Whether you're sending allowances, paying suppliers, or settling recurring dues, you can do it all safely and conveniently.

4. Lock or Unlock Your ATM Card Anytime

Misplaced your card—or just taking a break from spending? No worries—you’re in control. With PSBank Mobile, you can instantly lock your ATM card right from your phone to help keep your account secure.

Once you’ve found your card or are ready to use it again, simply unlock it through the app in just a tap. It’s a quick, secure, and convenient way to manage your card anytime, anywhere.

5. Start a Mobile Time Deposit Account

Got extra funds on your hands? Why not grow your money by investing through PSBank Mobile Time Deposit? You can start with a placement of PhP10,000, and choose from 30, 60, or 90-day terms.

6. Deposit Your Checks In a Snap

No time to visit a branch? With the PSBank Mobile Check Deposit feature, you can deposit checks directly to your personal savings or checking account. Just take a photo, submit it through the app, and wait for confirmation—it’s simple, secure, and hassle-free.

Rain or Shine, Maaasahan

Whether it’s raining outside or you’re just enjoying a slower pace at home, PSBank Mobile helps you stay on top of your finances—easily, securely, and without the extra hassle. Download the PSBank Mobile App today via the Apple Store, Google Play Store, or Huawei AppGallery. For more information on PSBank's products and services, visit psbank.com.ph or follow PSBank on Facebook.

PSBank Posts PhP2.16 Billion 1H2025 Net Income

Philippine Savings Bank (PSBank), the thrift banking arm of the Metrobank Group, registered a net income of PhP2.16 billion in the first half of 2025, driven by the steady growth of its core businesses and continuous efforts to reduce operational costs.

Stable demand across both consumer and SME lending segments continued to expand the Bank’s loan book, which grew by 16% year-on-year to PhP153 billion as of June 2025.

Core revenues, consisting of net interest income and service fees and commissions, rose by 7% year-on-year to PhP7.47 billion, while operating expenses decreased by 2% to PhP4.54 billion.

Pre-provision operating profit grew by 6% to PhP3.35 billion. On the other hand, credit provisions were higher this year as the Bank booked a one-time adjustment in its Expected Credit Loss model in 2024.

With the portfolio increase, gross non-performing loan (NPL) ratio was kept at 3.1%, lower than the Philippine banking industry average of 3.4% as of May 2025.

The Bank’s total resources reached PhP224 billion, while total deposits stood at PhP171 billion by mid-2025. Total capital improved to PhP46 billion, with a capital adequacy ratio of 24.6% and a Common Equity Tier 1 ratio of 23.5%—both are well above the regulatory minimum set by the Bangko Sentral ng Pilipinas and are among the highest in the industry.

“As we enter the second half of the year, we remain committed to meeting our customers’ evolving needs by delivering innovative financial solutions in an increasingly competitive market,” said PSBank President Jose Vicente Alde.

Recently, the Philippine Rating Services Corporation (PhilRatings) assigned PSBank the highest Issuer Credit Rating of PRS Aaa (corp.) with a Stable Outlook. The rating reflects the Bank’s solid market position, sound capitalization and asset quality, strong support from its parent bank, experienced management team, and the positive outlook for its core market.

PSBank also successfully closed its bond offering period, ending ahead of schedule as the total orderbook exceeded 6 times the initial offer size within one day. Proceeds from the issuance will provide the Bank with access to long-term funding to support expansion initiatives and further diversify funding sources.

PSBank shortens offer period for its latest bond issuance

Philippine Savings Bank (“PSBank” or the “Bank”), the thrift banking arm of the Metrobank group, disclosed that it has decided to shorten the offer period for the third tranche under its PhP40 Billion Bond Programme. The initial offer period of August 4 to 8, 2025 was cut short and closed within a day due to strong investor demand from both institutional and retail clients. The total orderbook was more than six (6) times oversubscribed, indicating the market’s continued confidence in the Bank.

The Bank’s latest bond issuance has a tenor of two (2) years and carries a fixed interest rate of 5.875% per annum. The issue and listing date will be on August 18, 2025.

The net proceeds of the issuance will provide the Bank with access to long-term funding to support its expansion initiatives and further diversify its funding sources.

First Metro Investment Corporation (“First Metro”) and ING Bank N.V., Manila Branch (“ING”) were the Arrangers, while the Selling Agents were PSBank, First Metro, ING, and Metropolitan Bank & Trust Company.

PSBank to Issue Peso Bonds Under PhP40 Billion Bond Programme

Philippine Savings Bank (PSBank), the thrift banking arm of the Metrobank Group, is set to issue Peso-denominated Fixed-Rate Bonds as part of its ongoing PhP40 billion Bond Programme. This will mark the third tranche under the program, following the PhP6.3 billion issuance in July 2019 and the PhP4.65 billion issuance in February 2020.

PSBank has mandated First Metro Investment Corporation (“First Metro”) and ING Bank N.V., Manila Branch (“ING”) as Arrangers for the upcoming issuance. The Selling Agents for the offering are PSBank, First Metro, ING, and Metropolitan Bank & Trust Company.

The proposed issuance will have an initial size of PhP2.0 billion, with an option to upsize. Net proceeds will provide the Bank with access to long-term funding to support its expansion initiatives and further diversify its funding sources. The bonds will have a tenor of two (2) years and will carry a fixed interest rate of 5.875% per annum. The minimum investment amount is PhP100,000, with additional increments in multiples of PhP10,000. The offer period will run from August 4 to 8, 2025, subject to adjustment by PSBank and the Arrangers as necessary.

The Bonds are intended to be issued and listed on the Philippine Dealing Exchange (PDEx) on August 18, 2025.

Adulting 101: Building Your Rainy Day Fund

Smart saving starts with PSBank Mobile

Smart saving starts with PSBank Mobile

Treating yourself is always great—but building your savings is even better. Having extra funds set aside gives you the freedom to enjoy life while staying prepared for those unexpected moments that can pop up when you least expect them.

Your savings can open doors to exciting possibilities like traveling to your dream destination, learning new skills, and reaching big life milestones with confidence.

The best part? You can get started with just your mobile phone with PSBank Mobile. Here are easy tips on how you can start building your rainy day fund:

- Start Small and Start Now

The key isn’t having a large deposit—it’s taking the first step and building the habit early. With PSBank Mobile, you can open an account anytime, anywhere with just one valid ID. There’s no minimum deposit and no maintaining balance, so you can begin with whatever amount you have—no pressure.

- Stay Consistent

Set a regular transfer schedule as even small, consistent amounts can go a long way in growing your rainy day fund over time. Automating your savings helps you build the habit effortlessly, so you can grow your fund without even thinking about it. You can also open multiple PSBank savings accounts to organize your money by purpose—whether it’s for short-term needs, future travels, or long-term goals like investments or big-ticket purchases. This way, your savings stay intentional and easy to track.

- Pay Your Dues on Time

Late fees from utilities, credit cards, and other bills can quickly add up over time. Avoid unnecessary charges by setting reminders or automating your payments through PSBank Mobile. This way, you stay on top of your bills and your savings.

- Keep Your Funds Safe

With PSBank’s fast, secure, and user-friendly digital platform, you can easily track your savings and manage your funds in real time.

PSBank Mobile also offers security features that put you in control. You can lock and unlock your ATM card and change your PIN regularly through the app, giving you added protection and peace of mind.

- Set Boundaries for Your Savings

Are you an impulse shopper? Keep your savings safe from budol finds by opening a PSBank Peso Time Deposit through the app. With an initial placement of just PhP10,000, your money earns more and stays secure. You can choose between a 30, 60, or 90 days term to make it easy to align with your savings goals.

Make banking a seamless part of your routine by using the PSBank Mobile app. Track your savings, schedule regular transfers, secure your account —anytime, anywhere. With everything at your fingertips, saving becomes an effortless habit that fits right into your daily life.

Download the PSBank Mobile App today via the Apple App Store, Google Play Store, or Huawei AppGallery. For more information on PSBank's products and services, visit www.psbank.com.ph or follow PSBank on Facebook and Instagram.

Hustle Made Simple: A Growth Guide for Entrepreneurs

Fuel your next big move with PSBank

Picture this: You’re gearing up for a brand-new workday—only this time, you’re the boss, building something that’s truly yours.

Exciting, right? But let’s be real—it can also feel overwhelming. Growing a venture means facing big dreams, tough decisions, and constant challenges. The good news is that with the right financial partner and a solid plan, scaling your business can be both manageable and achievable.

Whether you’re investing in equipment, replenishing inventory, or expanding your space, it’s important to know exactly how you’ll use your funds.

That’s where PSBank comes in —a reliable financial partner that helps you confidently invest in what matters most. PSBank offers various financing options that best fit your business needs and growth plans, empowering entrepreneurs like you to build businesses that last.

Ready to level up your business? Here are some practical tips to consider to support your next big move:

- Buying Fixed Assets Like Property, Equipment, or Vehicles

If you’re investing in major assets, you need financing that fits your cash flow. PSBank SME Term Loan offers various loan terms from one to seven years, giving you breathing room to grow while managing costs.

You can also earn rebates when you make early or excess payments, helping you lower total interest costs over time. These rebates are applied automatically and credited on your due date.

- Construction and Fit-Out of Business Locations

Building or renovating? PSBank SME Term Loan supports construction schedules with fund releases aligned to your project’s progress. Initial disbursements can go up to 60% of the appraised land value, giving you the liquidity to cover significant upfront expenses.

You can also opt for PSBank SME Business Credit Line—an accessible short-term financing solution that gives you ready funds to cover day-to-day operational needs, unexpected expenses, or additional project requirements as they arise.

- Additional Working Capital for Ongoing Operations

Running day-to-day operations like payroll, inventory restocking, and utilities can stretch your cash flow.

PSBank Business Credit Line gives you the flexibility to support these recurring needs.

You can also open a PSBank Corporate Account and get free access to Business Online Buddy, a platform that makes handling payroll, supplier payments, and other transactions quick and hassle-free. It’s all about making your day-to-day business smoother, so you can focus on what really matters: growing your company.

- Grow Your Business Without Touching Your Personal Savings

You don’t need to dip into your personal funds to grow your business. With PSBank SME Term Loan, you can access funding through collateral options starting at PhP500,000 with deposits or PhP2 million with real estate so you can level up your business while keeping your personal savings safe and intact.

Your Maaasahan Business Partner

From expansion to upgrades, PSBank makes it easy for business owners to take the next big step—with simple, flexible financing that fits your goals. Learn more about how PSBank can help your business by visiting the nearest PSBank branch or through its 24/7 Customer Experience Hotline at (632) 8845-8888. For more information on PSBank's products and services, visit www.psbank.com.ph or follow PSBank on Facebook.

This Father’s Day, Get Closer to Your Dream Ride

Start the journey with PSBank Auto Loan

As a dad, you wear many hats—driver, navigator, mechanic, and the family’s go-to guy for every trip.

For you, a reliable car isn’t just about getting from point A to B—it’s about being there for your family, whenever they need you.

This Father’s Day, give yourself the ride you deserve. With PSBank Auto Loan, getting behind the wheel is simple, fast, and hassle-free.

Fast, Flexible, and Made for Dad’s Busy Life

Let’s face it: buying a new car is a big investment. That’s why having the right financing partner makes all the difference. With everything you juggle each day, car financing should be the least of your worries.

Start your journey by planning ahead with the PSBank Auto Loan Calculator, which helps you estimate your potential monthly payments in just a few clicks. Once you're ready, you can apply for a PSBank Auto Loan online—and get a loan decision in as fast as 24 hours.

Managing your payments is just as simple.You can make payments through PSBank Mobile, PSBank Online, over-the-counter at any PSBank branch, or at 7-Eleven stores, among others.

And here’s a bonus: when you make advance or excess payments, you automatically earn rebates through the Prime Rebate feature. That means you can reduce your total loan amount, shorten your loan term—or even both.

And because every dad loves a good deal, you can also check PSBank’s Pre-Owned Cars at budget-friendly prices. You can either browse available units online, or drop by the PSBank Pre-Owned Auto Mart at 8003 Lands R Us Realty Compound, Manalac Avenue, Bagong Tanyag, East Service Road, Taguig City. Units are available for viewing from Monday to Saturday, 8:00am to 4:30pm.

Dad’s Maaasahan Partner

For dads juggling work, family, and everything in between, it’s about having a reliable partner on the road—with help from PSBank Auto Loan with Prime Rebate to make it all possible.

Apply for a PSBank Auto Loan through PSBank Online Loan Application, or visit your nearest PSBank branch. For more information, visit www.psbank.com.ph or follow PSBank on Facebook.

Power Up Your Plans with a Flex

Borrow up to PhP250,000 extra funds and pay your way with PSBank Flexi Personal Loan

Adulting is hard. Finding extra cash when life happens? That used to be harder—until now.

Whether it’s surprise home repairs, tuition fees, or emergency medical bills, unexpected expenses don’t have to hold you back. With PSBank’s Flexi Personal Loan, you’ve got a financial backup that’s ready to use when you need it.

When life throws surprises your way, it’s time to Flex—with PSBank Flexi Personal Loan.

Manage your funds your way with PSBank Flexi Personal Loan. Borrow up to PhP250,000 and enjoy the freedom to choose the loan option that suits your lifestyle—a revolving credit line or a fixed term loan.

With a revolving credit line, you can borrow, repay, and borrow again—no need to reapply. If you prefer steady monthly payments, a fixed term or deferred loan gives you repayment options of 24 or 36 months with fixed monthly installments.

PSBank Flexi Personal Loan can be accessed through a free ATM card so you can conveniently access funds anytime, anywhere in any Mastercard-affiliated ATM worldwide.

Payment is easy — you can pay in any of your preferred channels: PSBank Mobile, PSBank Online, over-the-counter at any PSBank branch, 7-Eleven Stores, BancNet ATMS, InstaPay, and Online Bills Payment Services. You can also track and manage your loan in real time through the PSBank Mobile App.

Meanwhile, PSBank Flexi Personal Loan’s Prime Rebate program helps you save on interest over time. Rebates are computed daily and automatically applied to qualified term loans—rewarding you for paying early or more than the minimum due.

Time to Flex

Not sure where to start? Use the Loan Calculator and pre-qualification checklist on the PSBank website to get a quick idea of how much you can borrow.

Get the backup you deserve. Apply now for a PSBank Flexi Personal Loan via the PSBank Online, or visit your nearest PSBank branch. For more information on PSBank's products and services, visit psbank.com.ph or follow PSBank on Facebook and Instagram.

Three Simple Ways to Boost Your Business Efficiency

From payroll to payments - streamline and simplify your business operations with PSBank

Whether you’re a seasoned entrepreneur or just starting out, managing and growing a business is not easy.

From overseeing payroll to ensuring bills, suppliers, and client payments are settled on time, managing these responsibilities can quickly become overwhelming.

Without the right tools or support, it’s easy to fall into operational pitfalls that slow your business down. To help you stay on top of your game, here are three ways to optimize your business operations with help of the right banking partner like PSBank.

- Simplify Payroll: Manage It Online, Not Manually

No matter the size of your workforce, manually processing payroll twice a month can be both time-consuming and prone to errors. It’s a critical responsibility that adds to the already demanding load business owners carry.

With PSBank, payroll doesn’t have to be a hassle. Opening a Corporate Account gives you free access to Business Online Buddy (BOB), a platform designed to simplify business transactions for business owners.

Through PSBank’s BOB, business owners can disburse salaries directly to PSBank Payroll Accounts in just a few clicks. It’s a faster, safer, and more accurate way to handle payroll to give you and your team one less thing to worry about.

- Stay On Track: Automate Your Payments

Day-to-day operations often involve making sure utilities, rent, and supplier payments are settled on time. But with so much to manage, it’s easy for dues to slip through the cracks—resulting in late fees and operational hiccups.

Stay on top of payments with PSBank’s BOB. You can set up Auto-Credit Arrangements and access a wide network of accredited billers. Whether it’s utility bills, rent, or recurring supplier payments, everything can be handled online to make sure that payments are on time every time. You can even schedule recurring payments, disburse bulk payouts to vendors, or collect payments from clients, reducing manual errors and minimizing delays.

- Stay on Top of Cash Flow: Track Your Finances Anytime, Anywhere

Staying on top of business finances requires clear visibility and secure management. Without consolidated tracking, it’s easy to lose sight of your cash flow or mismanage business funds.

You can avoid this by monitoring accounts in real time and have access to up to three months’ worth of transaction history with PSBank’s BOB. For added security, PSBank’s BOB offers multi-step authorization and user access management, allowing role-based permissions for team members. This means full control over who can view and manage specific financial tasks—ensuring transparency and accountability.

Your Maaasahang Buddy for Growth

Grow your business by streamlining financial processes with PSBank. You can open a PSBank Corporate Account at your nearest branch to get started. Access to PSBank’s Business Online Buddy (BOB) is free for all PSBank Corporate Accountholders. Learn more at www.psbank.com.ph.

This Mother’s Day, Do Something for You

Say yes to your goals with PSBank Flexi Personal Loan

Being a mom is a 24/7 job—no time-outs, no log-offs. Between managing work, school projects, family meals, and everything in between, it’s easy to lose sight of one very important person: You.

This Mother’s Day, celebrate saying yes to yourself—because prioritizing your dreams isn’t just smart, it’s empowering. With PSBank Flexi Personal Loan, you can confidently and affordably take the next step toward your goals.

Fund Your Passion Projects

Whether you’re ready to launch that dream business, enroll in a new course, or finally bring a creative idea to life, the PSBank Flexi Personal Loan helps turn your plans into reality.

PSBank’s digital tools like the loan calculator and pre-qualification checklist can easily guide you in the application process with confidence. The Loan Calculator gives a preview of the monthly amortization based on the preferred loan availment and term.

Borrow up to PhP250,000 and enjoy flexible repayment terms of 24 to 36 months—giving you the freedom to move at your own pace and on your own terms.

Invest in the “New You”

It’s your turn to thrive. From scheduling that long-overdue check-up to starting a wellness routine or creating your own peaceful corner at home—this is your sign to focus on you. Prioritize your well-being, and let PSBank Flexi Personal Loan help make it happen.

And the best part? Your approved PSBank Flexi Loan comes with a free Flexi Mastercard that you can use to withdraw funds or swipe at any BancNet and Mastercard-affiliated establishments—seamless and stress-free.

Spend Without the Guilt

Moms are natural budget keepers—so it’s normal to feel a bit guilty about spending on yourself. With PSBank Flexi Personal Loan, you get more than just funds—you get flexibility. Rebates are computed daily and automatically applied to all qualified term loans, rewarding you for paying early or more than your monthly due.

Even better, PSBank Flexi Personal Loan works like a revolving credit line. This means once you repay what you’ve used, your available balance is replenished—ready to be used again when needed without having to reapply. It’s like having a financial safety net that’s always there when opportunity calls.

You can also access your funds 24/7 via ATM, and repay the way that works best for you—whether through PSBank branches, BancNet ATMs, PSBank Mobile or Online, InstaPay, or Online Bill Payment Services.

Mom’s Maaasahan Partner

This Mother’s Day, choose to invest in yourself with PSBank Flexi Personal Loan. Apply for a PSBank Flexi Personal Loan with Prime Rebate online via PSBank Mobile, PSBank Online, or visit your nearest PSBank branch. For more information on PSBank's products and services visit www.psbank.com.ph or follow PSBank on Facebook and Instagram.

PSBank Registers Q1 2025 Net Income of PhP 1.2 Billion

PSBank, the thrift banking arm of the Metrobank Group, reported a net income of PhP 1.21 billion in the first quarter of 2025, up by 1% compared to the same period last year, driven by sustained lending and effective expense management.

Core revenues—which include net interest income, service fees, and commissions—grew by 9% to PhP 3.81 billion, up from PhP 3.49 billion in the same period last year. Operating expenses were lower by 3% as the Bank continued to benefit from improved productivity and operational efficiency.

Total gross loans expanded to PhP 152 billion as of March 2025, marking a 19% year-on-year increase, propelled by growth in auto, mortgage, and small-to-medium enterprise (SME) lending. Asset quality remained healthy, with the Bank’s gross non-performing loans (NPL) ratio improving to 2.6% from 3.4% in Q1 2024.

Total assets stood at PhP 222 billion, while total deposits and capital reached PhP 170 billion and PhP 45 billion, respectively. PSBank’s capital adequacy ratio of 23.5% and Common Equity Tier 1 ratio of 22.4% remain well above the regulatory minimum set by the Bangko Sentral ng Pilipinas and are among the highest in the industry.“Consumer loan demand has remained high and as long as economic conditions continue to be stable, we are optimistic to capitalize on this trend in the coming months," said PSBank President Jose Vicente Alde.

PSBank was also recently recognized with Silver Anvil Award for its online video campaign and a Bronze Stevie® Award for its 2023 Annual Report—affirming the Bank’s commitment to excellence in communication and stakeholder engagement.

PSBank Sets Record-High Net Income of PhP 5.2 Billion, up 15% in 2024

Philippine Savings Bank (PSBank), the thrift banking arm of the Metrobank Group, posted an all-time high net income of PhP 5.21 billion for the year 2024, up 15% from PhP 4.53 billion in 2023. This resulted in a higher return on equity of 12.4% compared to 11.7% last year. The robust double-digit growth in loans, coupled with significant improvements in asset quality, fueled the Bank’s outstanding financial performance.

Core revenues, composed of net interest income, service fees and commissions, rose by 4% to PhP 14.11 billion. Increase in operating expenses remained under control at 4% as the Bank pursued its cost optimization strategies.

PSBank’s total gross loans grew by 15% year-on-year to PhP 144 billion as of December 2024, boosted by strong demand across both consumer and commercial lending segments. Despite the expansion in loan portfolio, the Bank was able to keep its gross non-performing loans ratio in check at 2.6%, better than 3.3% a year ago.

The Bank’s total assets closed at PhP 216 billion while total deposits reached PhP 165 billion by yearend 2024. Capital funds improved by 10% to PhP 44 billion, translating to a total capital adequacy ratio and common equity tier 1 ratio of 23.6% and 22.5%, respectively. Both ratios are above the regulatory minimum set by the Bangko Sentral ng Pilipinas and are among the highest in the industry.

"Our record-high performance reflects our commitment to sustainable growth and quality, and the unwavering trust of our clients," said PSBank President Jose Vicente Alde. "Looking ahead, we expect to capitalize on the growing and evolving needs of consumers."

PSBank’s success extends beyond financial performance. In 2024, the Bank received numerous awards, including the Quill Awards for outstanding corporate communications, the Silver Anvil Awards for multimedia and public relations excellence, and the Double Golden Arrow Recognition for outstanding corporate governance from the Institute of Corporate Directors. Additionally, PSBank was named the SSS Kabalikat ng Bayan Best Disbursement Partner – Thrift Bank Category and one of Philippines’ Best Employers 2025 by the Philippine Daily Inquirer and Statista.

PSBank also launched an enhanced mobile banking app in 2024, featuring a smoother, more userfriendly interface and customizable features for a personalized banking experience.

Protect Your Digital Activities Amid Surge in Online Scams

As online fraud reaches unprecedented levels, Filipinos are reminded to stay vigilant and strengthen their digital security—a key message underscored by Safer Internet Day, an annual global movement advocating for a safer and more responsible online experience.

According to the Cybercrime Investigation and Coordinating Center (CICC), cybercrime complaints more than tripled in 2024, with 10,004 cases filed—a staggering rise from 3,317 in 2023.1 These scams led to PHP198 million in total financial losses, highlighting the growing sophistication of fraud, particularly consumer fraud and online financial fraud, which together account for 67% of all reported cases. Fraudsters continue to exploit deceptive tactics such as fake online sales, impersonation scams, investment fraud, and phishing to steal sensitive information like passwords and one-time PINs (OTPs).

Recognizing the growing vulnerabilities of OTPs, the Bangko Sentral ng Pilipinas (BSP) is pushing for stricter security regulations to strengthen the country’s financial cybersecurity framework. As part of this effort, the BSP has proposed regulatory changes aimed at enforcing Republic Act No. 12010, or the Anti-Financial Account Scamming Act (Afasa), which was signed into law last year to combat financial cybercrimes. This includes requiring banks to continuously enhance their security infrastructure, implement stronger authentication measures, and adopt more advanced fraud detection systems to stay ahead of cybercriminals2.

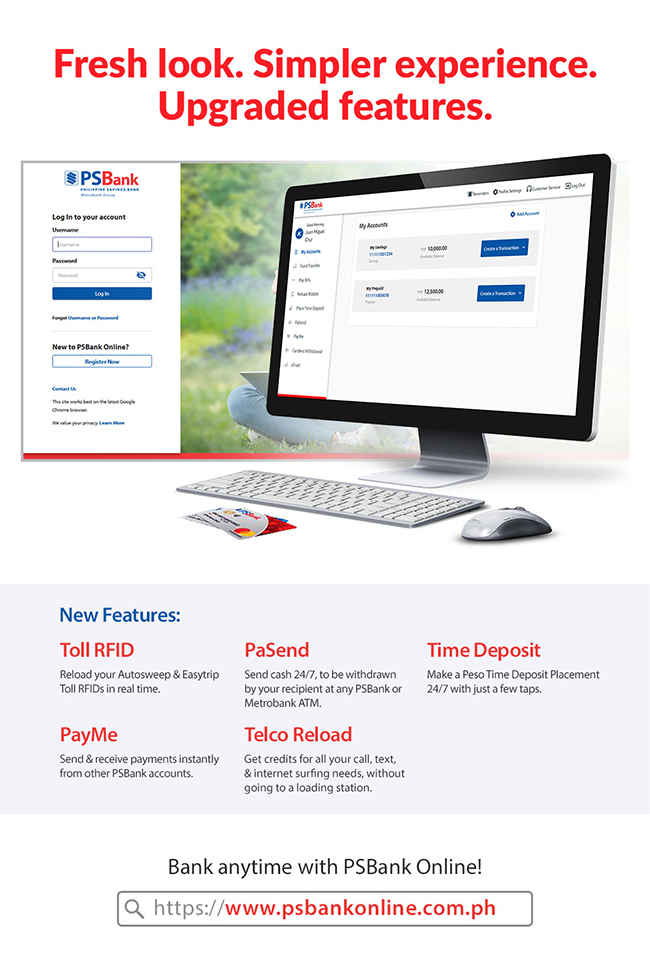

PSBank is reinforcing its commitment to security through key enhancements to its PSBank Mobile app. Clients now have the ability to lock access to their accounts on platforms they don’t usually use, ensuring that their PSBank accounts remain restricted to their preferred and regularly utilized channels. They can

also lock or unlock their ATM cards through the app, providing an extra layer of protection against unauthorized transactions.

Beyond security, PSBank Mobile continues to simplify digital banking with a faster, more seamless account opening process, removing the waiting period for verification and allowing customers to open an account with just one valid ID and a selfie. The app also offers zero initial deposit requirements, real-time bill payments, RFID reloading for tolls, and lower InstaPay transfer fees—ensuring that users can enjoy safe and hassle-free banking.

While security systems evolve, vigilance remains the most powerful defense against online fraud. To minimize risks, users are encouraged to follow these key digital safety practices:

- Verify sender identities – Always double-check emails, messages, or calls claiming to be from banks or government agencies. Scammers often impersonate trusted institutions.

- Avoid clicking on suspicious links – Phishing scams rely on fake websites that mimic legitimate

platforms to steal login credentials. Always access bank websites and apps directly.

- Use strong, unique passwords – Avoid using the same password across multiple accounts. Enable two-factor authentication whenever possible.

- Never share banking credentials – Banks will never ask for your PIN, OTP, or account details via email, text, or call. If someone requests this information, it's likely a scam.

- Monitor account activity regularly – Frequently check your bank statements and transaction history for any unauthorized activity. Report suspicious transactions immediately.

- Report scams promptly – If you fall victim to fraud, contact your bank and report the incident to the government’s 1326 cybercrime hotline, available 24/7 to assist victims.

As cybercriminals continue to innovate, fortifying your digital security is no longer just an option—it’s a necessity. This Safer Internet Day serves as a strong reminder that while financial institutions enhance their digital defenses, users must also remain proactive and vigilant. Fraudsters may adapt, but with the right security measures and a well-informed digital banking community, Filipinos can continue transacting online with confidence.

1 Philippine News Agency. (2025, January 31). Scam complaints triple in 2024 – CICC. https://www.pna.gov.ph/articles/1243101

2 Bangko Sentral ng Pilipinas. (2025, January 22). Amendments to Regulations on Information Technology Risk Management to Implement Section 6 of the AntiFinancial Account Scamming Act (AFASA). https://www.bsp.gov.ph/Regulations/Issuances%20of%20Policy%20Exposure%20Drafts/Exposure-Draft_Amendments-toRegulations-on-IT-Risk-Management-to-Implement-Section-6-of-the-Anti-Financial-Account-Scamming-Act.pdf

Equal Opportunities for All: PSBank Strengthens its Commitment to Empowerment and Inclusivity

(From left) PSBank representatives Jero Contreras, Philippe Tria, Ismael Dizon III, Theresa Joy Lumanlan World Vision Philippines’ National Director Dr. Harvey Carpio, PSBank’s Marketing Group Head Deanne Uy and People Experience Head Rex Jardinero, World Vision’s Precious Hope Basco and Montserrat Luna, and PSBank’s Denver Castro

As an advocate of the life-changing impact and value of education, PSBank never forgets to give back to the communities that share the same commitment. Last December 26, 2024 and January 15, 2025, PSBank invited the three Non-Government Organizations (NGOs) in their head office for the annual turnover of their monetary support. They have been supporting these NGOs for at least a decade already.

The representatives from Resources for the Blind, World Vision, and Chosen Children Village Foundation were given a warm welcome by representatives from PSBank. Each of these organizations share the common goal of equalizing opportunities to the underserved communities by guiding and supporting them in reaching their full potential through their various programs.

“For years, PSBank has been privileged to play a part in supporting initiatives that promote inclusion and empowerment for marginalized communities. This work would not have been possible without the unwavering commitment of our partners — Resources for the Blind, World Vision, and Chosen Children Village Foundation. Together, we hope to continue expanding opportunities and helping create brighter futures in the years ahead," said PSBank Marketing Group Head Deanne Uy.

PSBank and Chosen Children Village Foundation (CCVFI)

Chosen Children Village Foundation (CCVFI) provides a permanent home for abandoned, neglected, and surrendered children who are mentally and physically challenged. In this newfound home, they created a space where children can grow, reach their full potential, and become productive and self-reliant members of society. These children have been outcasted due to their differences however under CCVFI’s care, the disabilities and limitations of the children are no longer a hindrance to their growth.

Since 2011, PSBank’s donation has supported CCVFI’s residential care and life skills training for the mentally and physically challenged youth in their community.

PSBank and Resources for the Blind (RBI)

Resources for the Blind (RBI) provides well-rounded services to visually impaired individuals nationwide. These services include counseling, rehabilitation, education, and training. All of which ultimately works toward the unified goal of empowering them into reaching their potential in life. In addition to these programs, they are actively engaged in efforts for eye care and blindness prevention. RBI is also an organization that helps hearing impaired individuals receive access to quality education through a project initiated back in 2019 called GABAY Project.

“I gained a deep appreciation for the invaluable support PSBank provides in addressing the educational needs of our visually impaired elementary students enrolled in public schools. Your financial assistance has played a significant role in laying a strong foundation for their education and future.” said Monica Caminero, Inclusive Education Sponsorship Program Coordinator. PSBank has been donating to support education, training, and rehabilitation programs since 2004.

PSBank and World Vision

World Vision is dedicated to supporting the most vulnerable children, their families, and their communities in helping them break free from poverty and achieve a fulfilling life. Each year, World Vision supports approximately 1 million children, striving to create opportunities that foster mutual growth and pave the way for brighter futures for everyone they connect with.

“PSBank has been a steadfast supporter of World Vision’s mission, sponsoring 11 children and providing them with opportunities to grow, dream, and thrive. In July 2024, PSBank’s support for our Back-to-School campaign through venue sponsorship helped us achieve an incredible 800,000 in media mileage. This same campaign equipped 24,000 children with the tools and resources they needed to pursue their education.” said Dr. Harvey Carpio, World Vision Philippines National Director. PSBank has been a steadfast supporter of World Vision since 2004. The donation funds focus on the well-being of children, especially the most vulnerable, such as health and nutrition, education, and child protection.

This 2025, PSBank proudly marks its 14th year of supporting initiatives by Chosen Children Village and its 21st year of partnering with both Resources for the Blind and World Vision. As PSBank welcomes a new year, they remain true to their commitment on empowering these dedicated organizations in achieving their mission of promoting a more welcoming society.

Learn more about PSBank’s products and initiatives by visiting PSBank website.

Feng Shui to Finances: Prosperity Made Simple with PSBank

As 2025 begins, it’s the perfect time to align your financial goals with the principles of feng shui, the age-old practice of creating balance and harmony. At its core, feng shui emphasizes the importance of flow — an idea that resonates deeply with the journey to financial prosperity. PSBank, your trusted partner in simple and reliable banking, is here to help you transform these auspicious opportunities into meaningful success.

As 2025 begins, it’s the perfect time to align your financial goals with the principles of feng shui, the age-old practice of creating balance and harmony. At its core, feng shui emphasizes the importance of flow — an idea that resonates deeply with the journey to financial prosperity. PSBank, your trusted partner in simple and reliable banking, is here to help you transform these auspicious opportunities into meaningful success.

Feng shui teaches that small changes can create a ripple effect of positive energy, and the same is true for financial management. Consider these feng shui tips to help you achieve balance and abundance this year:

- Tidy Up Your Wallet: A clean, organized wallet attracts wealth and financial clarity. Remove unnecessary receipts and keep it stocked with some cash to symbolize abundance. Furthermore, it is advised to avoid using second-hand wallets.

- Incorporate Wealth Colors: Colors like black, brown, orange, pastel yellow, and green in your financial tools are believed to represent prosperity and good fortune.

- Mind the Front Door: Your home’s entrance symbolizes the flow of opportunities. Keep it clean and unobstructed to welcome positive energy, including financial prosperity. You can achieve this through brighter lighting and by adorning the entryway with plants to make the space more inviting.

- Activate the Southeast Corner: Known as the wealth sector, this area of your home can be enhanced with symbols of abundance like a jade plant, gold coins, or even financial documents. Utilizing these emblems signifies growth and prosperity.

- Declutter Key Areas: A cluttered desk or workspace can block the flow of energy. Tidying key areas symbolizes free room to let energy flow seamlessly. Ensure the space where you manage finances is clean and inviting to encourage fresh opportunities.

These tips can come handy but know that your actions towards financial success still lies in your hands and the steps you take to achieve this. Imagine starting the year with not just good intentions but actionable plans to secure your financial future. It’s time to ask yourself, What’s stopping me from taking the leap toward a more prosperous future? With PSBank, upgrading your financial future in 2025 becomes effortless.

PSBank’s products can make banking more simple and convenient, while also empowering you to achieve your financial goals. Applying for a loan, such as an auto or home loan, can help you make life-changing investments such as purchasing a car to improve daily commutes or securing a dream home for your family. You can also fund for your home renovation to keep it more tidy and organized with PSBank’s home credit line.

On top of this, save for a more bountiful future with a deposit account that can help you build financial security, offering a safe place to grow your savings, prepare for emergencies, or work toward long-term goals like education or travel. You can jumpstart the year by opening an account via PSBank Mobile. With just one valid ID and a few taps in the app you can have a savings account without the need for maintaining balance. You can also request for an ATM card, free of charge.

This year, you have the choice to let feng shui guide you toward balance and prosperity, and let PSBank be your trusted partner in the journey. PSBank ensures you are equipped with the tools that help turn positive energy into real-world success. Prosperity isn’t just about luck— it’s about taking progressive steps and making decisions that align with your aspirations. With PSBank by your side, your path to success is simple and effortless.

For more tips and information on PSBank’s products and services, visit psbank.com.ph or follow us on Facebook and Instagram.

Congratulations to the Winners of PSBank Rev Up Your Ride Promo!

Sleigh the holidays with the perfect family car

When it comes to family life, space, comfort and convenience are our utmost priority when it comes to choosing a vehicle. Whether it’s weekend getaways or long out-of-town drives this holiday season, the right car can make all the difference.

When it comes to family life, space, comfort and convenience are our utmost priority when it comes to choosing a vehicle. Whether it’s weekend getaways or long out-of-town drives this holiday season, the right car can make all the difference.

Today’s family-friendly vehicles come in all shapes and sizes to match your needs and lifestyle. Here are some options you can consider when choosing a car for your family.

- For starting families and small households: Compact cars and Sedans

If you’re a household of two to four, compact cars and sedans provide an excellent balance between affordability and functionality. These vehicles are ideal for urban commuting and short drives for weekend getaways while offering excellent fuel efficiency.

In the Philippines, these cars typically range from PhP700,000 to PhP1,000,000. Many brands offer models with hybrid versions, helping families save on fuel costs in the long run.

Despite their smaller size, many modern sedans offer foldable rear seats for added cargo space, entertainment-friendly touchscreens, and essential safety features like anti-lock brakes and electronic stability systems.

- For growing families: Crossovers and SUVs (6-7 Seaters)

As your family grows, crossovers and midsize SUVs provide the extra space and practicality you need. These vehicles often seat up to seven passengers and come with features like rear parking sensors, and hill-start and lane-keeping assistance. Cars like these can comfortably fit your family or group of friends on a road trip with extra space for your stuff. SUVs are also good for those who are adventure seekers and wish to go car camping especially this coming holiday break.

Priced from PhP800,000 to PhP1,500,000 and up, these vehicles combine comfort and style. Hybrid versions, though slightly more expensive, deliver excellent fuel efficiency without compromising power—ideal for traffic-heavy commutes or long drives.

- For large families: Vans and Full-Size SUVs (8+ Seaters)

Big families or those who frequently carpool will benefit from the spaciousness and flexibility of vans and full-size SUVs. With space for eight or more passengers, these vehicles offer unmatched flexibility for busy households and big families who love to go on trips together.

Prices range from PhP1,100,000 to PhP2,500,000 and up. Vans prioritize convenience with sliding doors and easy access to the rear rows, great for families with young children and elderly for effortless and easy entry and exit. Meanwhile, full-size SUVs blend power with comfort. Think all-wheel drive for rugged terrains, premium infotainment systems to keep everyone entertained, and advanced safety features like automatic emergency braking.

Investing in space, safety, and comfort

Family life moves fast, and the right car helps you keep up. Whether you’re navigating tight city streets or hitting the open road, there are modern yet affordable vehicles that offer the space, safety, and comfort that every busy and growing household needs.

And this holiday season is the time to upgrade and gift your family with a comfortable car that suits your needs. PSBank’s Auto Loan makes the process of upgrading your car simple and effortless. Apply online, get approved in as fast as 24 hours, and take the first step toward a car that fits your family’s lifestyle.

From October 15 to December 31, 2024, PSBank is offering an exciting promo for auto loan applicants. Customers stand a chance to win PhP50,000 worth of fuel e-vouchers or PhP10,000 in cash to be credited in their PSBank account. Don’t miss this opportunity to upgrade your family car and win these exciting prizes.

Spend Smart, Stress Less: Simplify your holiday spending

The holidays are a time to celebrate and give, but they can also get expensive and stressful if we’re not careful. To keep the season joyful (and budget-friendly), a few smart spending habits can go a long way. From setting a holiday budget and organizing your gift list, there’s a way to make the most of the season hassle-free while staying on top of your finances.

Set a budget (and your gift list!)

Setting a holiday budget can feel overwhelming—juggling gift lists, party expenses, and everything in between. The best place to start is knowing who you’re shopping for. Make a list of everyone you’d like to give a gift to and jot down a few budget-friendly ideas for each. Having a clear plan helps you avoid impulse buys and prioritize meaningful presents.

If you’re worried about sticking to your budget, PSBank Mobile app’s fund transfer feature can simplify things. You can immediately transfer your monetary gift to your loved ones’ accounts directly—quick, stress-free, and perfect for the busiest time of year.

Go digital for a smoother shopping experience

Keeping track of holiday spending can be tricky, especially when you’re juggling multiple transactions. Digital payment tools like QR codes are a lifesaver—no need to carry large amounts of cash or worry about complicated payment setups. PSBank’s QR code payment feature makes it easy to shop with just a scan, offering a seamless and secure way to settle purchases.

Skip carrying all your cards or cash

Holiday errands can be tedious especially when you do it last minute. It often requires quick access to cash, but carrying all your cards or large amounts of money can be risky. PSBank’s Cardless Withdrawal feature lets you withdraw cash securely from any PSBank ATMs using just your mobile phone—perfect for those spur-of-the-moment purchases or last-minute needs.

Don’t forget to gift yourself

While you’re busy giving to others, don’t forget to give yourself the gift of financial security. Opening a PSBank Mobile Savings account can be a thoughtful way to invest in your future. It’s an effortless way to build your funds while enjoying the festive season, ensuring you enter the new year on solid financial footing. You can effortlessly open an account with just one valid ID and opt to get the ATM that goes with it for free. You can do more with this app by opening a Mobile Peso Time Deposit account and allow your money to grow for a period of 30, 60, or 90 days with guaranteed fixed-rate returns.

Celebrate without financial stress

The holidays are all about giving, but it doesn’t have to come at the cost of financial stress. With a little planning and the right tools, you can enjoy a festive, stress-free season. PSBank Mobile makes holiday spending simple, so you’re covered wherever the season takes you.

Simply own it: Things to consider when getting your first property

If you’re looking for a sign to buy your first set of wheels, this is it! The holiday season is fast approaching, and with it comes the excitement of bonuses and incentives – making now the perfect time to take the leap.

If upgrading your daily commute has been on your mind, there's no better time than now. With irresistible promotions, booming car sales, and favorable loan options, 2024 could be the year you drive into the holidays in style. Read through to learn how you can secure an auto loan approval in just hours plus a limited time promo that will surely make your holidays merrier.

Car sales are booming (More choices for you!)

The Philippine automotive market has been growing steadily over the last decade, with a notable peak in 2017 when sales hit a record 487,000 units. Although there was a slowdown due to the pandemic, the market has rebounded impressively.

This rapid growth means more options for you! Car manufacturers are offering a wider variety of models at different price points. Whether you’re eyeing a fuel-efficient compact like the Nissan LEAF or need a spacious and eco-friendly family vehicle like the Toyota Innova Zenix, there’s something for everyone – and just in time for those holiday road trips.

Bonus season means more affordable car payments

The holiday season brings more than just festive cheer. It’s also when most employees receive their 13th-month pay and other bonuses. These windfalls provide the perfect opportunity to cover upfront costs when buying your first car, allowing you to enjoy the convenience and freedom of having your own vehicle. No more rushing to beat the commute during rush hour!

Lower interest rates and flexible terms

Majority of financial institutions have been offering competitive auto loans rates in recent years making car ownership more accessible than ever.

As car sales continue to soar and promotions grow more attractive, now is the perfect time to turn your dream car into a reality. With the market poised for record-breaking sales and financial institutions like PSBank offering low interest rates and flexible payment options, there’s never been a better moment to make a purchase.

PSBank Auto Loan Promo

PSBank's Auto Loan is designed to make the car-buying process simple and convenient. You can apply online and receive approval within 24 hours, so you can take advantage of the latest deals and promotions. From October 15 until December 31, 2024, PSBank is offering an exciting promo where customers stand a chance to win PhP10,000 in cash or up to PhP50,000 worth of fuel e-vouchers with their auto loan application. Visit PSBank’s promo page to learn how you can qualify for the promo.

To know more about PSBank auto loans, visit https://www.psbank.com.ph/loans/auto. You can also compute your monthly amortization through PSBank’s Loan Calculator.

PSBank Posts All-time High Net Income of PhP4.53B, Up 23% in 2023

PSBank, the thrift banking arm of the Metrobank Group, reported a record-high net income of PhP4.53 billion for the full year 2023, up 23% from PhP3.68 billion in 2022. This translates to a return on equity of 11.7%. The Bank’s strong financial performance came from the double-digit growth in loans, higher investment revenues and muted costs brought by operational efficiencies. Net interest income improved to PhP11.83 billion, increasing by 7% year-on-year while operating expenses declined by 1% due to continuous cost optimization efforts of the Bank.

"This significant milestone was a result of team work and steadfast commitment of PSBankers in delivering effortless banking to our clients and stakeholders. We want to leverage on this momentum to expand our coverage, provide diversified offerings and further invest in technology to level up customer experience in the succeeding years,” President Jose Vicente L. Alde said.

PSBank’s gross loan portfolio expanded by 12% to PhP125 billion from previous year’s PhP112 billion. Auto loans grew by 24% driven by higher demand on vehicles. Despite the increase in the Bank’s loan portfolio, gross non-performing loans ratio decreased year-on-year from 3.5% to 3.3% at the end of 2023, indicating better credit quality.

As of December 31, 2023, total assets closed at PhP238 billion while total deposits reached PhP190 billion. The Bank’s capital registered at PhP40 billion with total capital adequacy ratio and common equity tier 1 ratio at a sturdy level of 24.5% and 23.6%, respectively. The capital ratios are above the minimum levels set by the Bangko Sentral ng Pilipinas and among the highest in the industry.

PSBank garnered various awards and accolades in 2023. The Bank was recognized as an Outstanding Stakeholder by the Bangko Sentral ng Pilipinas and received the Double Golden Arrow Recognition for Excellence in Corporate Governance from the Institute of Corporate Directors. It attained the highest credit rating from PhilRatings and was included in Forbes' list of the World's Best Banks, ranking 7th among Philippine banks. The Bank was also honored as the Best Disbursement Partner in the Thrift Bank Category in the SSS Balikat ng Bayan Awards and was awarded with Gold and Silver Anvil Awards by the Public Relations Society of the Philippines for the use of social media and for its Tap campaign online videos, respectively.

These recognitions and record-breaking performance served as a testament to the Bank’s dedication and continuous efforts to provide exceptional PSBanking experience to all its clients and stakeholders.

PSBank Nine-month Net Income up 18% at PhP 3.37 Billion

PSBank, the thrift banking arm of the Metrobank Group, registered a net income of PhP3.37 billion for the first nine months of 2023, up 18% year-on-year. Return on equity was higher at 11.7%. The results were driven by the continuous expansion of its core businesses, primarily from growth in the auto loan portfolio, complemented by effective expense management.

Net interest income increased to PhP8.82 billion while revenues from net service fees and commissions rose to PhP1.33 billion. Operating expenses were reduced by 1% as the Bank was steadfast in its productivity and operational efficiency initiatives.

The Bank’s total loan portfolio grew by 12% year-on-year to PhP123 billion as of September 2023 with auto loans up 24% fueled by increased vehicle sales. Asset quality remained healthy with a gross non-performing loans (NPL) ratio of 3.4%, better than pre-pandemic levels.

As of end 3Q, total assets amounted to PhP236 billion while total deposits reached PhP188 billion. Capital improved to PhP40 billion with Total Capital Adequacy Ratio and Common Equity Tier 1 Ratio at 24.6% and 23.7% respectively, with both ratios among the highest in the industry and above the minimum level set by the Bangko Sentral ng Pilipinas.

"Despite the unpredictable headwinds, we remain focused on sustaining our strong results while we continue to innovate on products, services and processes consistent with our commitment to deliver effortless banking to our customers,” President Jose Vicente L. Alde said.

For the third time, PSBank was conferred the Golden Arrow Award by the Institute of Corporate Directors (ICD) through the ASEAN Corporate Governance Scorecard (ACGS) for its excellence in corporate governance.

The Bank was also recently recognized by the Social Security System (SSS) as the “2023 Balikat ng Bayan Best Disbursement Partner - Thrift Bank Category”.

PSBank Posts Double-Digit Growth in 1Q Net Income

PSBank, the thrift banking arm of Metrobank Group, reported P976.88 million in net income for the first quarter of 2023 or a 10% jump compared to the first quarter of last year. This double-digit increase was propelled by expansion in consumer loan portfolio, improvements in credit quality and prudent expense management.

The Bank's net interest income rose by 8% year-on-year to P2.95 billion, while net service fees increased by 7% at P464.60 million. Operating expenses were lower by 5% to P2.19 billion as the Bank continued to pursue cost optimization strategies resulting from initiatives on operational efficiency.

Gross loans as of March 31, 2023 increased by 4% to P116.00 billion versus same period last year due to higher consumer demand as the country’s economy opened up. The Bank’s auto loan portfolio grew by 13% year-on-year on the back of higher demand for car financing. Improvements in asset quality were sustained with gross non-performing loans (NPL) ratio improving to 3.2% from 5.0% last year.

Total assets reached P255.76 billion as of 1Q2023 while deposits amounted to P209.81 billion with low-cost CASA funds totalling P73.29 billion. PSBank’s capitalization remains strong at P37.82 billion, with total capital adequacy and tier 1 ratios standing at 24.6% and 23.8% respectively. Both ratios are well above the regulatory minimum and are among the highest in the Philippine banking industry.

“Even as interest rates and inflation remain high, elevated consumer spending continues to persist which has fuelled significant retail loan demand for the early part of 2023. This works well for PSBank which primarily caters to the needs of the consumer market, specifically for their auto and mortgage loan requirements among others. As we remain cautiously optimistic for any possible short-term volatility attributed to overseas developments, we are equally confident of the organization’s ability to adapt to challenges, pursue business opportunities, and deliver well for our customers and stakeholders,” President Jose Vicente L. Alde said.

In March 2023, the Philippine Public Relations Society awarded PSBank Gold and Silver Anvils for the Bank's Official Facebook page and online account opening videos. The Anvil awards recognize PR tools and programs that meet the highest PR standards. Forbes' World's Best Banks for 2023 has recognized PSBank as one of the top 10 banks in the Philippines, making it the sole thrift banking institution included in the ranking. Published on April 11, the Forbes list was determined based on an online survey of more than 48,000 people in 32 countries. Participants were asked to rate their banks on general satisfaction covering the areas of: customer service, digital services, financial advice, terms & conditions, and trust.

PSBank Net Income Up 126% to PhP2.85 Billion

Philippine Savings Bank (PSBank), the thrift banking arm of the Metrobank Group, registered a net income of PhP2.85 billion for the first nine months of 2022, more than double growth of 126% year-on-year versus PhP1.26 billion in the same period last year. The solid income performance is a result of improvements in loan portfolio quality, increases in non-core revenue streams, gains from operational efficiencies, and improved loan volumes.

Net interest income reached PhP8.21 billion while revenues from net service fees, commissions and asset recoveries rose by 52% to PhP3.11 billion. Operating expenses remained in check growing only by 1% year-on-year. The Bank continues to implement productivity and operational efficiency improvements to manage costs even as investments are continuous to support digital initiatives.

Gross Non-Performing loans ratio went down significantly by almost half to 3.6% from 6.6% a year ago. With improving asset quality, the Bank reduced credit provisions to PhP969 million from PhP2.77 billion last year. Net Non-Performing loans ratio was at 1.6% by end-September 2022, an improvement from last quarter’s 2.0% and far lower than 3.9% of the same period in 2021.

PSBank’s total assets reached PhP252.96 billion as of September 30, 2022. Deposits were at PhP203.19 billion with low-cost deposits growing by 6% year-on-year. Total Capital funds grew 6% to PhP36.80 billion. Capital Adequacy and Equity Tier 1 Ratios improved further to 24.9% and 23.9% respectively, both of which are well above the regulatory requirement of the Bangko Sentral ng Pilipinas (BSP).

“Our retail proposition has been consistent. We have remained steadfast in our commitment to make banking simpler for our customers. With the improving levels of consumer spending, we have managed to book higher loan volumes specifically for auto and home during the first 9 months of 2022. We hope to see this momentum to carry through till year-end even as market conditions remain volatile. We will keep our digital service channels robust, reliable and secure, dedicated to consistently provide exceptional customer experience at every touchpoint,” PSBank President Jose Vicente L. Alde said.

With the industry move to shift to digital payments, PSBank recently enabled scanning of QRPh (“Scan to Pay”) as payment mode to retail stores and merchants via the PSBank Mobile. QRPh is the National QR Code Standard which unifies different domestic QR-based cashless payment schemes into one standard thereby allowing interoperability among participating institutions.

PSBank Doubles Net Income to PhP1.84 billion for 1st Half of 2022

Philippine Savings Bank (PSBank), the thrift banking arm of the Metrobank Group, reported a PhP1.84 billion Net Income for the first half of 2022, a year-on-year growth of 109% versus PhP0.88 billion in 1H2021. The rise in profit was propelled by continuous improvement in loan portfolio quality, expansion of revenues from other operating income, and controlled operating expense.

Net interest income reached PhP5.45 billion while net service fees and commissions grew by 13%. A strong revenue growth of 101% in other non-interest income lines was likewise achieved. These were driven by increased business activities from the opening-up of the economy, and further relaxation of mobility restrictions. Growth in operating expenses remained under control at 3% year-on-year as the Bank continues its productivity and operational efficiency initiatives.

Gross Non-Performing Loans contracted by almost half since 1H2021 thus reducing credit provisions to PhP625 million from PhP2.17 billion a year ago. Net Non-Performing loans ratio was at 1.96%, better than pre-pandemic levels.